PAGE which stands for Pan Asian Gold Exchange was set up in 2011 and has already begun operations with local Chinese buying and selling of gold through the internet. PAGE is located in Kunming, the capital city of Yunnan Province located in South Western China and is also the major gateway to South East Asia.

This gold exchange will enable ordinary Chinese buy/sell gold using a Renminbi account with a bank or broker. Currently there are two banks that are authorized to process the transactions or settlements and they are the Agriculture Bank of China and The Fudian Bank of Yunnan. The 10 ounce mini contracts will be known as T+D and the price is RMB 30,000 for 1 lot and it is fully backed by the Chinese government.

Also on offer is the Silver contract which is a five hundred ounce silver mini contract.

PAGE is not something that can be taken lightly as it is part of China’s 12th five year plan to catapult China to be the Global Superpower in Economics, Politics and Military.

Currently Shanghai Gold Exchange and Shanghai Futures Exchange are the only avenues for an ordinary Chinese citizen to buy gold. With the PAGE, now they will be able to buy gold through their computers online. Initially the scheme will be open to the 320 million customers of the Agriculture Bank of China.

Eventually foreigners will also be able to trade the International Spot Contracts on PAGE and hence this will help increase the liquidity of the market and certainly will have a big impact on both the LBMA and COMEX . With PAGE the purchaser will receive a 90 days International Spot Contract with the actual title bearing the name of the purchaser. All transactions initiated either by a local or foreigner will be denominated in RMB. Investors are given a choice to take physical delivery or get paid in RMB.

The setting up of PAGE is not a ‘spurred of the moment’ event but a carefully crafted strategic development in the key areas of China’s planned financial dominance in the next few decades.

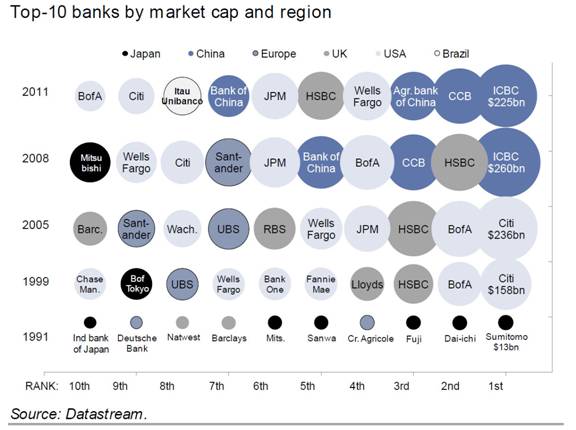

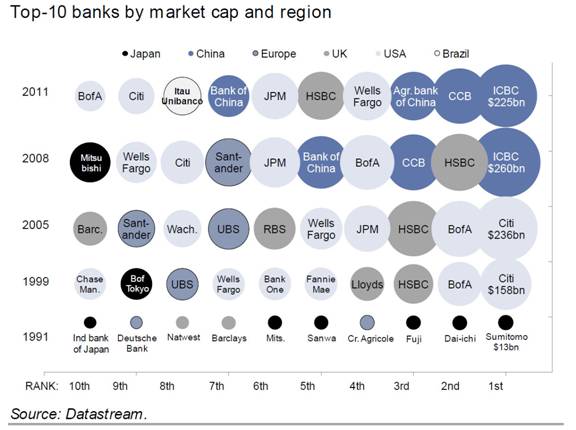

China’s dominance in the Banking world have already been felt and currently the top three biggest bank by market capitalization in the world are Chinese, namely ICBC, CCB and the Agriculture Bank of China. This can be shown by the chart below.

During the 1990s, out of the 10 largest banks in the world, 6 are Japanese and not even a single Chinese bank anywhere to be seen. In just a short time span of 20 years, China has already taken hold of the Global Banking Industry with 4 of its largest banks being in the top 10 rankings in the world. Even as recently as 2005 there is not even one Chinese Bank being represented in the top 10 and the speed in which the Chinese Banks dominating the global banking industry taken most analysts by surprise. Critics pointed out that it will be a rerun of the Japanese during the 1990s where today after 20 years there is not single Japanese Bank presence in the top 10 banks.

However, it should be noted that the Chinese banks are unlike the Japanese banks during the 1990s where they are spending their money in buying up unproductive US assets like golf courses in California, Rockefeller Center in New York and a host of other expensive real estates around the US. It even leads to pundits warning of an ‘imminent Japanese takeover’ of American assets.

However, the Chinese banks through their SOE (State Owned Enterprises) are buying up what they called the ‘hard assets’ or productive assets such as energy and mining companies, hugh blocks of agriculture lands in Africa, efficient and technologically advanced Western companies. Consequently, this will help to provide the necessary raw materials and technology to catapult its economic development to the next level.

The development of PAGE is just ‘part and parcel’ of the natural progression in the Vertical and Horizontal Integration of different business within an industry and in this case the financial industry. Next on the cards will be the rolled out of Mega Chinese Investment Banks with the stature of JPMorgan and the likes and eventually Shanghai being the Financial Center of The World.

What are the consequences when PAGE opens for international business in June 2012?

Internationalization of Renminbi (RMB)

FIRST, it will be the internationalization of the use of Renminbi, which will eventually replace the US dollar as an international reserve currency. This will further help promote the use of the Renminbi in the international arena and also help reduce the monopoly or dependence on the US dollar in the trading of precious metals. Since all trades in PAGE are denominated in RMB, a purchase by an international investor will initiate the buying of RMB and hence diversifying out of the dollar.

Such a move will greatly help the Chinese Authority to promote the RMB as the next world’s reserve currency by exposing it more to foreigners. Currently most of the trading of precious metals in the world are dominated by LBMA and COMEX and are quoted in US dollars, pounds or Swiss francs. However all this will be history when PAGE starts trading because all settlements will be in RMB.

This process will be further strengthened by the efforts of some countries in their abandonment of the US dollar as the international trade and reserve currency. Recently, during a meeting between the Japanese Prime Minister Yoshihiko Noda and Chinese Premier Wen Jiabao in Beijing, the Japanese government says that ‘Japan and China will promote direct trading of Yen and Yuan without using the US dollars and will encourage the development of a market for the exchange, to cut cost for companies’. The Japanese government further reiterated that Japan will start buying Chinese Bonds as of next year.

Other headlines include ‘China, Russia drop dollar in bilateral trade’, ‘China and Iran to bypass dollar, plan Oil Barter System’, ‘India and Japan sign new $15 billion currency swap agreement’ and ‘Iran, Russia replace dollar and use Rial, Ruble in trade’.

Austria has been granted the approval to purchase Chinese Bonds while Central Banks of Nigeria and Thailand are starting to buy Yuan denominated assets as returns from US and European assets are slowing down.

Furthermore, investing in Chinese debt has become easier for central banks as issuance of Yuan-denominated bonds in Hong Kong has more than tripled to 112 billion Yuan

Precious Metals Manipulation

SECOND, currently the gold and silver prices are highly manipulated. As we know, gold all along had been the arch rival of ‘fiat currency’. What happens to fiat currencies when people start converting all their paper currencies to gold? That will be the end of the paper currency regime. Hence the authorities will do whatever they can to suppress the true value of gold so as to make it less attractive than ‘fiat currency’ even though most of their value had already been debased by more than 95%.

Continue reading