When one hears talks about the collapse of the dollar, it is hard to picture how a currency that is the base of all global transactions can simply disappear. An important point to understand is that such a collapse does not occur at once. It takes a while to happen because that is how it has been arranged. What most people are clueless about is that, not only is the death of the dollar possible, but that it has already started.

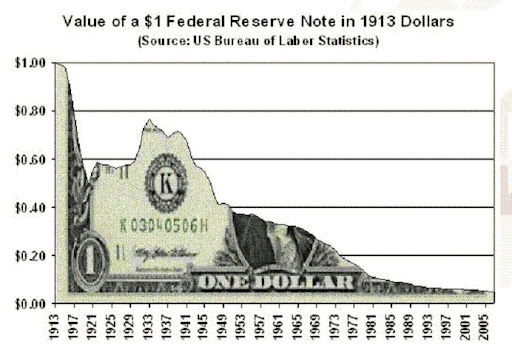

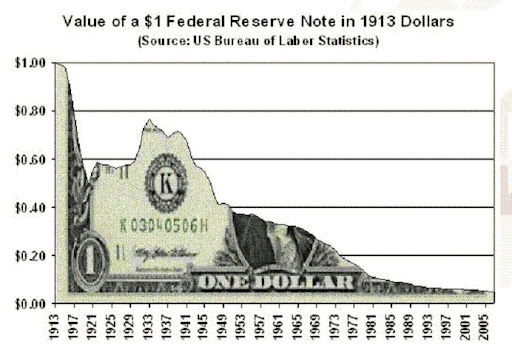

Since the dollar became the world’s currency by design, the American currency has lost a great deal of value. According to the U.S. Bureau of Labor and Statistics, one dollar

today is worth only about 5% of what the green back was worth back in 1913. More recent signs of the loss of relevance the dollar has had in the global economy is the fact that major commercial power houses –American commercial partners and foes– have officially adopted new ways to conduct commercial transactions. For example, China and Russia are now using their own currencies to deal with the purchase and sale of products. Another case is that of India and Japan. They have also resourced to their own currencies to carry out trade.

The dollar has not only lost value, but also credibility. The origin of the lack of trust on what once was the base currency on which every single product and service was priced –including gold– is the United States’ thirst for debt as a ‘development’ model. Today more than ever before, the American government depends on the issuance of debt as a way to keep up with its spending. For that reason, the country’s central bank, the Federal Reserve, has come up with all kinds of circus moves to slow down an outcome that seems imminent: the complete collapse of the U.S. dollar currency.

The influence of the Fed in the way the U.S. manages its debt to GDP ratio stems from the country’s inability to make payments on the cash it has borrowed from the Fed itself, as well as China and other foreign investors who own much of the American debt. The path chosen by the Fed to temporarily deal with the American inability to make payments on its debt –which continues to grow out of control with every passing day– is to make large purchases of government bonds and to use quantitative easing –the pumping of unlimited amounts of electronic money– in an attempt to make everyone feel good about the state of the economy.

The Fed’s intention is to make clear to the world that the U.S. has meaningful ways to prevent a default, because since all important transactions are carried out in dollars and the dollar is the world’s currency, the private central bank can issue fake money for as long as it wants. The obvious consequence of indefinitely pumping cash into the economy is hyperinflation, which has not happened because banks were ordered not to put the money they were given out into the market in the form of loans.

It seems that the Fed has everything figured out and that the collapse of the dollar will not come as soon as some economists have predicted, but the reality is very different. According to a study conducted by four prominent economists, it is almost crunch time for the Fed and the U.S. government. Right now, the least of the problems for the central bank and the American government is not lack of credibility, but a strong change of a fiscal crisis. The report was prepared by David Greenlaw, Managing Director and Chief U.S. Fixed Income Economist at Morgan Stanley; James D. Hamilton, Professor of Economics at University of California at San Diego and Research Associate of the National Bureau of Economic Research; Peter Hooper, Managing Director and Chief Economist, Deutsche Bank Securities Inc; and Frederic S. Mishkin, Alfred Lerner Professor of Banking and Financial Institutions, a Graduate of the School of Business at Columbia University and former Chairman of the Federal Reserve Bank.

What these four men found, is that the actions of the Federal Reserve caused massive inflation to a level where the dollar’s purchasing power has gone down in free fall . As the very same Federal Reserve policy books say, the goal is to devalue the currency by at least another 30 percent. The 89-page report states that reductions in fiscal revenues and excessive increase in government spending, the close relationship between sovereign debt and the levels of interests to be paid on the debt, a significant relation between debt loans and borrowing costs and the direct effects of the fiscal crises on monetary policy have been combined to render a single outcome: massive losses for countries and institutions such as the U.S. Federal Reserve that will exceed available capital.

What these four men found, is that the actions of the Federal Reserve caused massive inflation to a level where the dollar’s purchasing power has gone down in free fall . As the very same Federal Reserve policy books say, the goal is to devalue the currency by at least another 30 percent. The 89-page report states that reductions in fiscal revenues and excessive increase in government spending, the close relationship between sovereign debt and the levels of interests to be paid on the debt, a significant relation between debt loans and borrowing costs and the direct effects of the fiscal crises on monetary policy have been combined to render a single outcome: massive losses for countries and institutions such as the U.S. Federal Reserve that will exceed available capital.

What this means is that, if things continue business as usual, even the Fed will become unable to sustain the current fiscal crisis. According to the report, the Fed may enter unknown territory where the amount of debt created will exceed its capital holdings. What will happen when the Fed gets to its limit and can no longer maintain the current debt-based system? According to the authors, the more a country’s debt is held by foreigners the greater the political incentives for the government to default on that debt. This is what has been seen in developing countries. The day of reckoning for the Fed may come as early as 2016. If better fiscal and monetary policies are adopted, the disaster could be put off until 2018.

It is then necessary to remember who are the United States’ investors. As of December of 2012, the Federal Reserve System, which is a branch of the international banking cartel came up as first. In second place is China, with $1202.9 billion. After China, other countries like Japan, Brazil, Switzerland and Russia appear in third, fourth and fifth places. With the U.S. debt reaching and passing 100% of its GDP and the government borrowing and printing money as if it were going out of fashion, the only possible outcome is what we have seen in modern cases of fiscal irresponsibility.

Countries get in debt up to their eye balls to fulfill the promises made at home during by irresponsible politicians during political campaigns. Since the government does not have any money to actually pay for the expenses it creates, it is only ‘normal’ to get in debt to be able to meet demands for more social programs and to pay interests on old debt. But since the governments do not borrow locally, they subject their country, (i.e. the people) to having to work all their lives to make payments on the debt generated on the debt it has gotten into. The ability of a government to make debt payments is finite. Cases in point Argentina in 199o, Greece in 2008 to 2012, Portugal and Spain in 2013 and the looming fiscal crisis the United States will have to face in the near future.

The supposed programs to help nations pay their debt is nothing more than an attempt to slow the collapse of the global economy and the that assures foreign debt holders they will have enough time to loot the countries for all they have gotten. That is the ultimate form of payment used by the international banking cartel uses to recover their so-called investments. Different from Argentina, Greece, Portugal and Spain, it is hard to see how the Americans will allow the bankers to suck every drop of blood for not paying its debt, which is why negotiations have been held to find the least painful way to phase the dollar out. Although the bankers want every single penny back, they prefer to get it in the most peaceful way possible as supposed to having to face street protests as it has happened in Egypt, Libya, Syria, Argentina, Spain and Portugal.

In conclusion, the current system of debt creation as the base for development has reached the end of its life cycle. The consequences to come should the United States continue to print or issue fake money to pay its debt instead of cutting down spending and making big international corporations liable for evading the payment of corporate taxes, will make it impossible for the U.S. government to pay its debt and for the Fed to issue fake money to sustain the current system. The only reason the U.S. has not collapsed as a debtor nation is due to the demand for U.S. Treasuries at home and abroad, which has been maintained due to the dollar’s status as the world currency. That status however, is a subjective and ephimerous concept. The moment more nations decide to trade with their own currencies, or to set up sound monetary systems such as the one Muammar Gaddafi intended to create in Libya –the gold dinar–, the more credibility and trust the dollar will lose. Lack of trust and the impossibility to meet fiscal obligations will end up destroying the dollar.

As the authors put it simply, high debt leads to higher interest rates and higher debt. The high levels of debt reach a tipping point –fiscal crisis– in which the interest rate shoots up. In the case of the U.S. it has many of the possible triggers of that shoot up in interest rates and the only thing that is holding them from going through the roof is an imaginary belief that the U.S. is still that powerful economic entity that it appeared to be many years ago.